The world is changing drastically from all angles of life. From technology, business, and finance, there is a booming growth of technologies and services. All of these aim to improve the lifestyle of people like us. MOVO Digital Prepaid Visa Card has a similar goal that makes banking, money transfer, and more a piece of cake.

But how practical is the card? Does it serve the purpose of a regular debit card? Is using a card with your money secure without an actual bank or governing institution looking after it? MOVO has introduced a new age to digital banking and cryptocurrency. With MOVO, you’re not only getting a seamless, no-contact option for digital banking, but it also keeps in check with crypto money.

Continue scrolling through here to get a MOVO Digital Prepaid Visa Card review and decide if you’d get a card for yourself.

Table of Contents

What is MOVO Digital Prepaid Visa Card?

MOVO introduces on-demand online banking with a new twist. Its goal is to enable tier customers as they securely receive money. But that is not just it. They can also spend their money or, if feeling generous, send money. All of this from the convenience of a mobile phone, even if you don’t have an existing bank account. With a MOVO Digital account, you can have contactless payments with MOVO digital cash.

Teenagers and young millennials lean more toward crypto as we progress. Now, investment is not limited to stocks and mutual funds. People are also looking at crypto coins with great financial potential. MOVO Digital Prepaid Visa Card is great for parents who want to give financial freedom to their children. Parents can add the desired amount they think is suitable for their children. And the child can learn about good financial habits while making purchases. The drawback, however, is a lack of parental monitoring of these transactions. MOVO is for users who are good with technology and like something that deviates from standard banking methods. Hence, teenagers are the best choice, and you should go and sign up for a MOVO Digital account today! Even if you’re not good with digital banking or technology. It is relatively easier to operate on the MOVO app. One needs a little practice on the app to learn its ropes.

How is MOVO Digital Banking helping you?

The MOVO Digital account is mainly aimed at young adults. Although that doesn’t mean anyone above that can’t use MOVO. The app has a lot of banking features for adults and parents. This makes banking more accessible and transactions flawless. If you are under 18, you can operate a MOVO Bank account using your parent’s card. With a MOVO bank, you learn your fiscal responsibilities and how to spend wisely.

Seamless Digital Banking

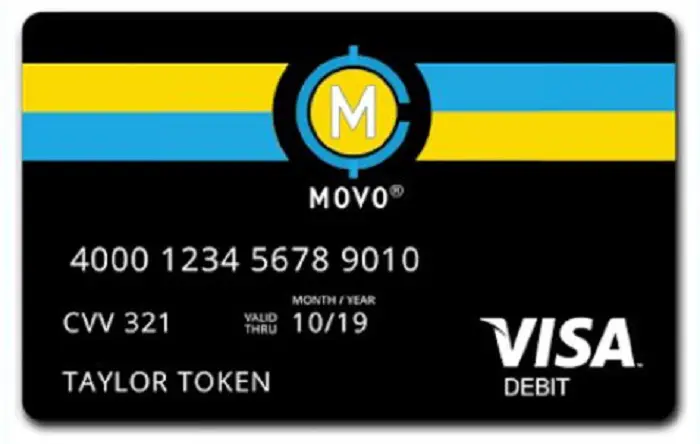

You start your journey with MOVO banking with a MOVO virtual card. You can switch to change to a physical card later on. The MOVO Digital Prepaid Visa Card is accessible across all banks for material, online, or other transactions. Any place that accepts a Mastercard will also accept MOVO cards.

Users can also make cards for MOVO Digital CASH. These digital cards differ from the primary debit card linked to an account. These contain unique card numbers that can only be used once. Many MOVO cardholders buy CASH cards to protect their budgets and money, especially during large transactions or when they don’t want to be charged. Getting a subscription that renews automatically is one of the examples provided by MOVO.

Saving Money

A MOVO Digital Prepaid Visa Card is a prepaid card. With prepaid cards, you can top it up with the money you want. This allows you to limit your bad spending habits.

A standard bank account stores all your cash in one place. Hence, it is hard to control your spending urges. With a prepaid card, however, you can change that by only adding the limited money you will spend. Although, you have to resolve not to add money beyond your spending limit.

Crypto and Cash

MOVO Digital Banking has another incredible, quirky perk called the MOVO Chain. This is precisely what makes MOVO better. Teenagers are heavily interested in crypto nowadays. With the MOVO chain, one can quickly turn crypto money into USD. The funds can be sent to someone else through their contact details. Or one can load it up on their debit card.

Some crypto coins this platform supports include Bitcoin, Ethereum, Doge Coins, USD Coin, BUSD, and more. They must then provide recipient information. At this stage, they might send money to a friend or themselves. After that, they enter the sender’s details and verify the transfer.

How can Parents use MOVO?

Parents can use MOVO accounts for ACH bank transfers. Or other routine banking procedures one expects, such as cash deposits, check deposits, or direct deposits. Account opening does not require a minimum deposit and complete registration. Direct deposit transfers and ACH transactions are not subject to any daily cash deposit cap of $500.

This account can support the most is one physical and one digital debit card.

How to open a MOVO Account?

There are no monthly maintenance fees, direct deposit transfer fees, cash deposit fees, or activation fees. The physical card fee is $5.95, and the inactivity fee is $4.95. Refused ATM withdrawal fee is $0.50. POS PIN debit purchase fees of $0.50 + 3%, and MOVO Chain transfer fees of $1 + 2%.

What are some Drawbacks of MOVO?

MOVO claims that it aims to target teenagers in creating a new-age digital banking solution. This allows young adults to get their first approach towards banking, cash, and more. They learn fiscal responsibility. However, the most significant setback created through this is the lack of guidance.

While it is true that children under 18 can create a MOVO Digital account, the responsibility of topping it up with cash is with the parents. MOVO Digital account, however, provides no aid to parents. They can top up the cards for their children. There is no option to limit spending. You can not get push notifications or track where your child spends all their money.

This puts the brand back by a few because although the MOVO Digital account is a new and fresh approach to traditional banking, it lacks some transparency. Even conventional banks that allow children’s accounts give parents rights and monitoring rights to look over their children’s fiscal activities.

Visit: MOVO

FAQs

Conclusion

An excellent prepaid debit card with some intriguing benefits like crypto trading and one-time digital cards. This card provides good security and accessibility features. It will work best for those who desire a fully digital, spending-focused banking experience and less well for those who prefer a traditional checking account or an account with additional family-friendly features.

However, a card aims to help teens with financial responsibilities. It gives a wrong message about being financially responsible. Suppose you, as a parent, are looking for your child to have their own spending space and card. This, however, might not be the best option if you’re trying to teach the responsibility of spending wisely and creating good saving habits. Go for MOVO Digital Prepaid Visa Card.

Learn everything that is related to Router Login, IP Addresses in an extremely simple way. Also get access to all the usernames and passwords of different routers.